News Release

July 8, 2024

Assessor Wynn Releases Property Assessment Roll

Sacramento County Property Assessment Roll Sets New Record

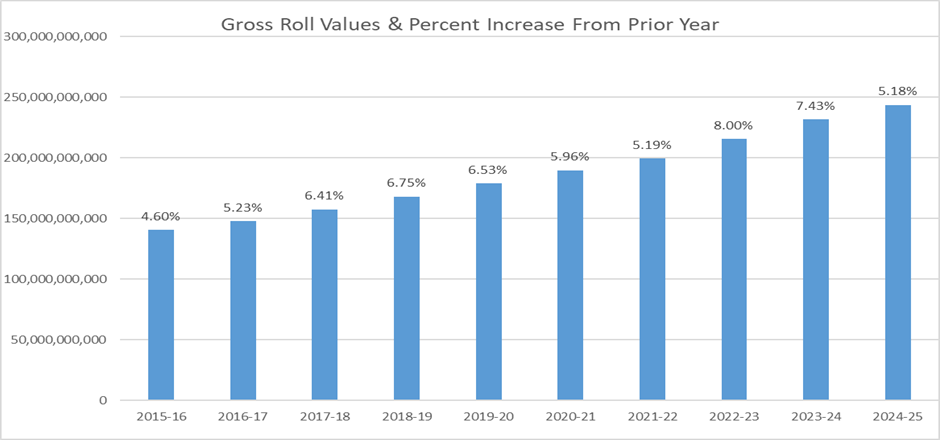

Sacramento County Assessor Christina Wynn announced today that the annual assessment roll reached a new record high of nearly $243 billion, a 5.18% increase over last year. The assessment roll reflects the total gross assessed value of locally assessed real, business, and personal property in Sacramento County as of January 1, 2024. After the deduction of property tax exemptions for homeowners, disabled veterans, and charitable organizations, the net assessed value is just over $231 billion.

The annual increase is primarily attributed to the sustained increase in average home prices over the last few years and ongoing new housing development and construction projects.

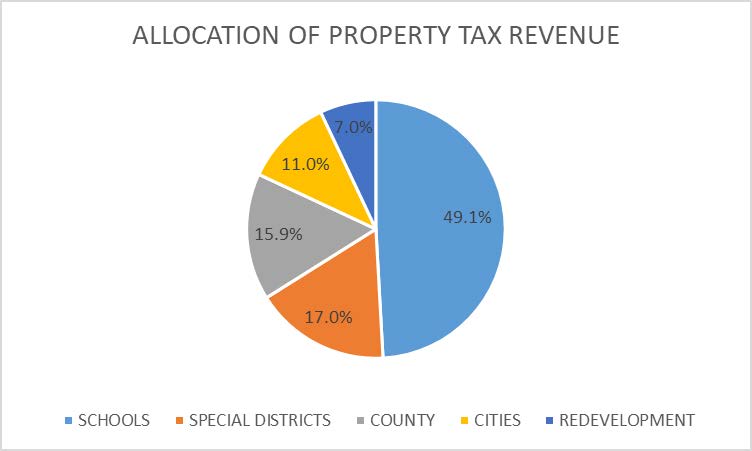

The 2024-25 assessment roll will generate approximately $2.3 billion in ad valorem property tax revenue. This year’s roll growth will yield an additional $115 million in gross revenue over last year. Property tax revenue funds over 175 local government agencies, including schools, special districts such as fire, park, and community service districts, as well as cities, and redevelopment agencies and is one of the largest sources of discretionary revenue for Sacramento County’s General Fund.

While the total assessed value for the County increased by 5.18%, the assessed value of most properties increased only 2% due to the protections of Proposition 13. Most of the roll growth resulted from assessed values established at current market levels for properties that changed ownership or experienced new construction in 2023. Properties appraised and assessed at market value each year include properties impacted by decline in value conditions (Prop 8), mobile homes, and personal property not subject to Proposition 13 such as boats, aircraft, and business personal property. The values of these properties may fluctuate more than 2% each year.

The 2024-25 assessed values of secured real property are viewable using this link to access the Assessor’s “Assessed Value Look-Up” and “Parcel Viewer” website tools. Property owners who disagree with their assessed value should contact the Assessor’s office to discuss their concerns. If the market value of a property is less than the assessed value, property owners can request a review online, by mail, or in-person. This free service is available July 1, 2024 – December 31, 2024. Any corrections to annual secured real property values processed by September 1 will appear on the annual property tax bill issued in October. Corrections processed after September 1 will require the issuance of a revised annual secured real property tax bill.

The Tax Collector will mail 2024-2025 unsecured property tax bills beginning July 12th. For questions regarding business personal property and fixtures, taxpayers can contact the Business Personal Property Division at (916) 875-0730 or PPdutyapr@saccounty.gov. Taxpayers can contact the Marine and Aircraft section to get assistance with vessels and general aircraft valuations at (916) 875-0740 or ASR-marine@saccounty.gov. Leased equipment questions can be referred to (916) 875-0745 or ASR-leasing@saccounty.gov.

Visit the Assessor’s website assessor.saccounty.gov to learn about property tax savings programs or contact us at assessor@saccounty.gov or (916) 875-0700. Technical staff and duty appraisers are available in-person weekdays 8-5, no appointment necessary, at 3636 American River Drive, Suite 200, Sacramento (free parking).

Stay Connected! Get County News as it happens by signing up for SacCountyNews.